Page 4 - West Virginia FCU Fall 2017 Newsletter

P. 4

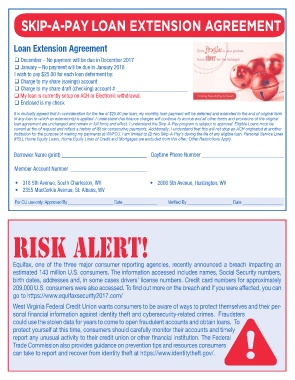

SKIP-A-PAY LOAN EXTENSION AGREEMENT

Loan Extension Agreement

December – No payment will be due in December 2017

January – No payment will be due in January 2018

I wish to pay $25.00 for each loan deferment by:

Charge to my share (savings) account

Charge to my share draft (checking) account # __________________________

My loan is currently setup on ACH or Electronic withdrawal.

Enclosed is my check

It is mutually agreed that in consideration for the fee of $25.00 per loan, my monthly loan payment will be deferred and extended to the end of original term

of any loan to which an extension(s) is applied. I understand that finance charges will continue to accrue and all other terms and provisions of the original

loan agreement are unchanged and remain in full force and effect. I understand the Skip-A-Pay program is subject to approval. Eligible Loans must be

current at the of request and reflect a history of (6) six consecutive payments. Additionally, I understand that this will not stop an ACH originated at another

institution for the purpose of making my payments at WVFCU. I am limited to (2) two Skip-A-Pay’s during the life of any eligible loan. Personal Service Lines

(PSL), Home Equity Loans, Home Equity Lines of Credit and Mortgages are excluded from this offer. Other Restrictions Apply.

Borrower Name (print) ______________________________ Daytime Phone Number _____________________________

Member Account Number ___________________________

• 318 5th Avenue, South Charleston, WV • 2600 5th Avenue, Huntington, WV

• 2355 MacCorkle Avenue, St. Albans, WV

For CU use only: Approved By __ Date Verified By __ Date

RISK ALERT!

Equifax, one of the three major consumer reporting agencies, recently announced a breach impacting an

estimated 143 million U.S. consumers. The information accessed includes names, Social Security numbers,

birth dates, addresses and, in some cases drivers’ license numbers. Credit card numbers for approximately

209,000 U.S. consumers were also accessed. To find out more on the breach and if you were affected, you can

go to https://www.equifaxsecurity2017.com/

West Virginia Federal Credit Union wants consumers to be aware of ways to protect themselves and their per-

sonal financial information against identity theft and cybersecurity-related crimes. Fraudsters

could use the stolen data for years to come to open fraudulent accounts and obtain loans. To

protect yourself at this time, consumers should carefully monitor their accounts and timely

report any unusual activity to their credit union or other financial institution. The Federal

Trade Commission also provides guidance on prevention tips and resources consumers

can take to report and recover from identity theft at https://www.identitytheft.gov/.