Page 4 - WVFCU - Fall Newsletter

P. 4

SPRINT MELVIN CAMPAIGN

Newsletter Copy & Custom Link for

West Virginia Federal Credit Union

!

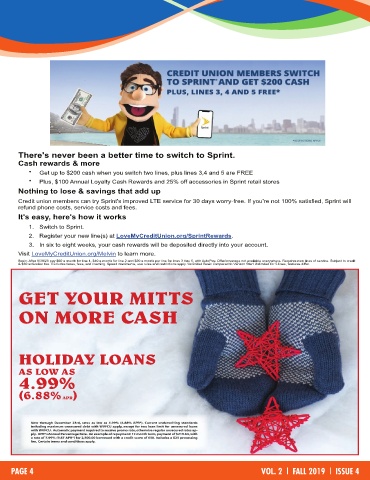

There's never been a better time to switch to Sprint.

Cash rewards & more

• Get up to $200 cash when you switch two lines, plus lines 3,4 and 5 are FREE

• Plus, $100 Annual Loyalty Cash Rewards and 25% off accessories in Sprint retail stores

Nothing to lose & savings that add up

Credit union members can try Sprint's improved LTE service for 30 days worry-free. If you're not 100% satisfied, Sprint will

refund phone costs, service costs and fees.

It's easy, here's how it works

1. Switch to Sprint.

2. Register your new line(s) at LoveMyCreditUnion.org/SprintRewards.

3. In six to eight weeks, your cash rewards will be deposited directly into your account.

Visit LoveMyCreditUnion.org/Melvin to learn more.

Basic: After 9/30/20 pay $60 a month for line 1, $40 a month for line 2 and $20 a month per line for lines 3 thru 5, with AutoPay. Offer/coverage not available everywhere. Requires new lines of service. Subject to credit

& $30 activation fee. Excludes taxes, fees, and roaming. Speed maximums, use rules and restrictions apply. Unlimited Basic compared to Verizon Start Unlimited for 5 lines, features differ.

GET YOUR MITTS

ON MORE CASH

HOLIDAY LOANS

AS LOW AS

4.99%

(6.88% APR)

Now through December 23rd, rates as low as 4.99% (6.88% APR*). Current underwriting standards

including maximum unsecured debt with WVFCU apply, except for two loan limit for unsecured loans

with WVFCU. Automatic payment required to receive promo rate, otherwise regular unsecured rates ap-

ply. APR*=Annual Percentage Rate. An example of repayment: 12 month term, payment of $219.63, with

a rate of 7.99% (9.87 APR*) for 2,500.00 borrowed with a credit score of 650. Includes a $25 processing

fee. Certain terms and conditions apply.

PAGE 4 VOL. 2 | FALL 2019 | ISSUE 4