Page 4 - WVFCU: Community Connection: Spring 2022

P. 4

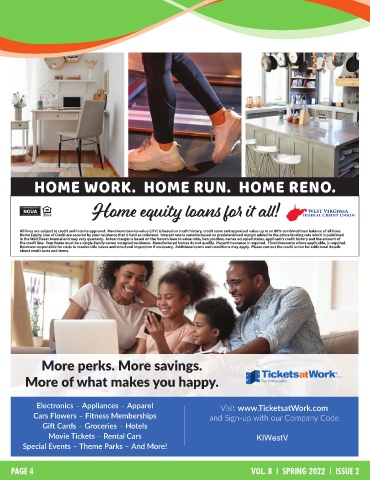

Home Equity Line of Credit

flexibility allows you access

www.wvfcu.org to funds when you need them.

FAST approvals and

professional service.

Call 304-744-MYCU (6928)

or stop by any of our 4

locations today to apply.

• NO Annual Fee . . . EVER!!!

• Competitive Rates

• Low Payments

• Local Decisions & Servicing

• No Closing Costs

• Potential Tax Advantages*

HOME WORK. HOME RUN. HOME RENO.

All lines are subject to credit and income approval. Maximum loan-to-value (LTV) is based on credit history, credit score and appraised value up to an 89% combined loan balance of all liens. Home Equity Lines

of Credit are secured by your residence that is held as collateral. Interest rate is variable based on predetermined margins added to the prime lending rate which is published in the Wall Street Journal and may

vary quarterly. Actual margin is based on the home’s loan to value ratio, lien position, owner occupied status, applicant’s credit history and the amount of the credit line. Your home must be a single-family owner Hom equit loan fo i al

!

occupied residence. Manufactured homes do not qualify. Hazard insurance is required. Flood insurance where applicable, is required. Borrower responsible for costs to resolve title issues and structural inspection,

if necessary. Additional terms and conditions may apply. Please contact the credit union for additional details about credit costs and terms. *Consult a Tax Professional regarding the tax deductibility of interest.

All lines are subject to credit and income approval. Maximum loan-to-value (LTV) is based on credit history, credit score and appraised value up to an 80% combined loan balance of all liens.

C177946-26048 HOMEEQPROOF.indd 2 9/9/16 8:56 AM

Home Equity Line of Credit are secured by your residence that is held as collateral. Interest rate is variable based on predetermined margin added to the prime lending rate which is published

in the Wall Street Journal and may vary quarterly. Actual margin is based on the home’s loan to value ratio, lien position, owner occupied status, applicant’s credit history and the amount of

the credit line. Your home must be a single-family owner occupied residence. Manufactured homes do not qualify. Hazard Insurance is required. Flood Insurance where applicable, is required.

Borrower responsible for costs to resolve title issues and structural inspection if necessary. Additional terms and conditions may apply. Please contact the credit union for additional details

about credit costs and terms.

More perks. More savings.

More of what makes you happy.

Electronics – Appliances – Apparel Visit www.TicketsatWork.com

Cars Flowers – Fitness Memberships and Sign-up with our Company Code

Gift Cards – Groceries – Hotels

Movie Tickets – Rental Cars KIWestV

Special Events – Theme Parks – And More!

PAGE 4 VOL. 8 | SPRING 2022 | ISSUE 2